Artificial Intelligence on the Verge of Breakout: Embarking on a journey that traces back to the 1930s, recent progress in generative AI marks significant advancements that extend beyond mere technological innovations, influencing various industries. These state-of-the-art algorithms act as digital maestros, seamlessly orchestrating tasks such as summarizing emails, crafting responses, generating meeting updates, composing slideshows, and intricately engaging in the dance of writing and debugging code. The role of AI transcends that of a mere tool; it stands as a trusted collaborator, amplifying human potential.

Despite the promising advancements, the true value of AI remains a captivating mystery. Projections from financial oracles like Morgan Stanley and Goldman Sachs paint a picture of substantial economic impact, estimating values of $6 trillion and $7 trillion, respectively, by the poetic year of 2030.

In the midst of this symphony of AI, enter the financial maestros – hedge fund billionaires, each seeking their part in the grand crescendo of AI adoption. Consider David Tepper, the visionary founder of Appaloosa Management, who recently orchestrated a 32% surge in his Microsoft holdings—adding 395,000 shares to conduct a total of 1.64 million shares, valued harmoniously at $619 million. Microsoft’s remarkable performance in the fiscal 2024 first quarter, especially in Azure Cloud with a resounding 29% year-over-year growth, and the introduction of the Microsoft 365 AI Copilot, played notes that resonated with Tepper’s confidence. Analysts, resembling musical critics, suggest that Microsoft’s AI symphony, including the Copilot movement, could compose a substantial financial crescendo, solidifying its position as a market virtuoso.

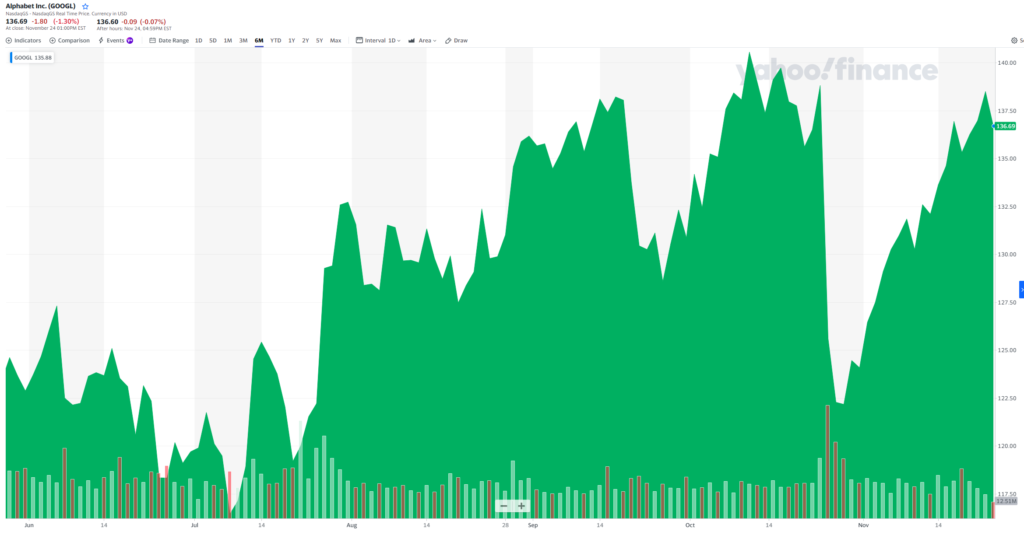

Then, there’s Bill Ackman, the activist investor known for transforming investments into sagas. Managing Pershing Square Capital Management, Ackman’s confidence in AI is evident in his recent masterpiece—bolstering his stake in Alphabet. Envision an addition of 2.17 million Class A shares, akin to adding new instruments to an orchestra, nearly doubling the ensemble to a harmonious 4.35 million. Combining this with existing holdings of 9.38 million Class C shares creates a symphony of 13.73 million Alphabet shares, a melodious value of $1.89 billion. This constitutes over 17% of Pershing Square’s portfolio—a significant movement in the financial sonata. Ackman’s strategic investment dance aligns with his belief in Alphabet’s dominance, not just in search and online advertising, but also in cloud infrastructure—a full orchestration of technological prowess. The recent expansion of Alphabet’s AI expertise adds an extra layer to this symphony, a strategic value that echoes and resonates with Ackman’s investment rationale.

In the grand concert of risk and reward within the financial world, these hedge fund virtuosos are orchestrating their investments with a harmonious blend of human intuition and the transformative melodies of artificial intelligence.